Centralized exchanges remain considerable amounts out of affiliate financing, so they are primary objectives to possess cyberattacks. While they convey more robust security measures, such as multi-basis verification (MFA), insurance coverage, and you can cooler stores to have cryptocurrency, they can be attacked. Various Assets Served – This type of programs service all sorts of cryptocurrencies, providing investors the opportunity to offer in almost any some other gold coins otherwise tokens all at once. Hackers tend to address centralized transfers using their centralized characteristics, posing a top exposure for highest-level breaches.

Hypertrade aggregator – Exchangeability on the Centralized Exchanges

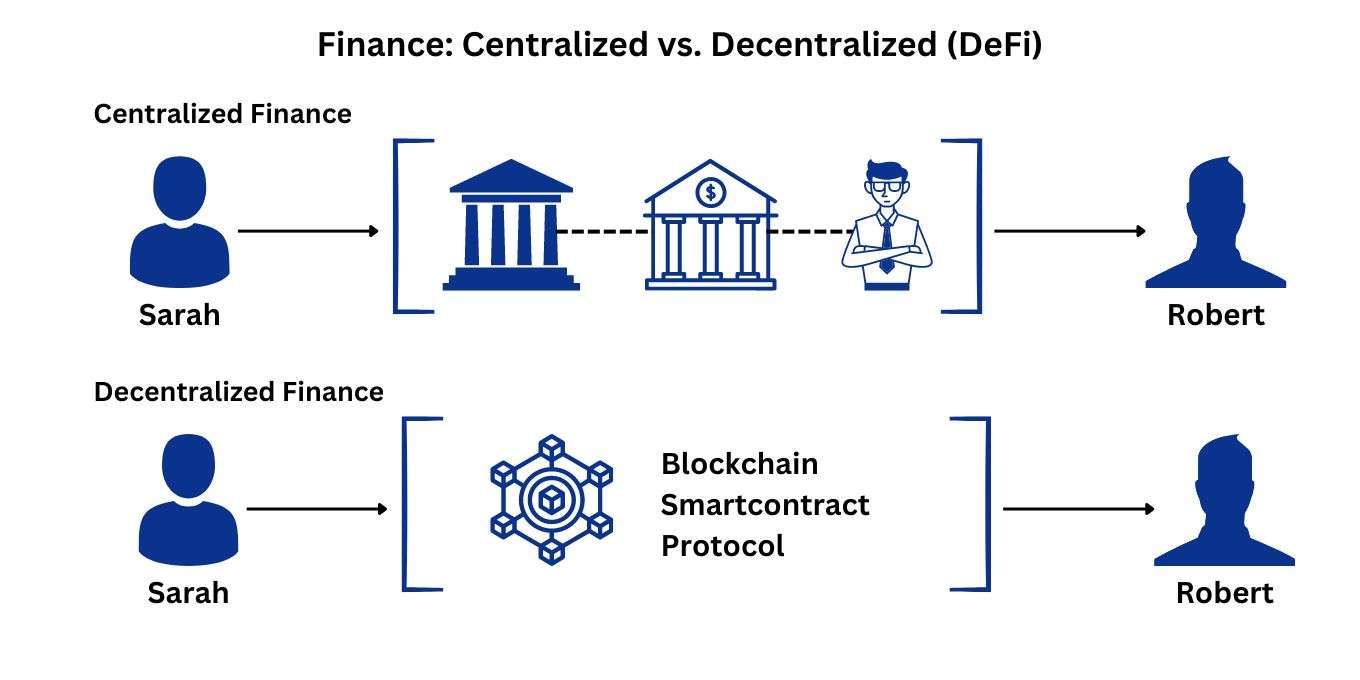

Constructed with newbies planned, they give user-friendly dashboards you to definitely clarify trading jobs. Global collaborations and you will the fresh regulating buildings are being recommended to make sure DEXs is work legitimately and offers the users confidentiality and you can freedom. Centralized transfers (CEXs) tend to play the role of intermediaries ranging from people and you can sellers, setting him or her less than regulatory analysis. DEXs along with have confidence in the new blockchain to include visibility and protection. Just after a deal is actually submitted, it gets a permanent the main blockchain, ensuring tamper-research details.

Consumer experience and Entry to

At the same time, CEXs become more prone to defense breaches, because they shop pages’ funds on a centralized server. If your server is hacked, all of the fund stored involved might possibly be taken. However, reliable CEXs apply numerous security measures, for example a few-grounds authentication, cool shop, and you may insurance, to protect its pages’ financing. Centralized crypto-transfers could possibly get in the near future be obsolete as they remove the opportunity to leverage blockchain technical to switch the potential and results.

Uniswap v3 enacted protection analysis by Path from Bits and ConsenSys Diligence. The new audits receive no important weaknesses inside key wise agreements. Uniswap guides in the DeFi trading, capturing 65% from full DEX share of the market.

The selection between a central and you will hypertrade aggregator decentralized replace hinges on personal tastes and you may goals. Both the purchase publication and automatic field inventor possibilities provides the restrictions. For order book transfers, too little available exchange people can result in the a slowly change date – and you can slippage – for your requirements. At the same time, AMMs offering worst perks because of their exchangeability company may possibly see on their own which have a shortage. Making this something to be considered when weigh right up a great DEX vs an excellent CEX.

Loan providers just operate throughout the business hours, usually 5 days weekly. That means if you attempt to put a check for the Friday at the 6 p.m., you will probably need to hold back until Saturday early morning to see the bucks in your account. For every candidate you may following be provided with a particular bag target, plus the voters do publish its token otherwise crypto for the address away from any kind of applicant they would like to choose to own. The newest transparent and traceable character of blockchain do get rid of the you desire to own human choose counting plus the feature away from bad actors to help you tamper which have real ballots.

Centralized against Decentralized Transfers: Deciding on the best Exchange to suit your Crypto Travel

Clients would be to perform their research otherwise consult with a specialist prior to monetary behavior according to our very own content. Detachment process are projected to become smaller due to technological improvements, reducing downtime, and boosting associate fulfillment. Security measures in the CEXs are usually robust, protecting investment. Nonetheless they provide certain trading equipment and you may enhanced functions, assisting strategic investment decisions.

Liquidity

Versus centralized transfers (CEXs), an element of the trouble with P2P DEXs is because they generally have reduced exchangeability. Consequently any kind of time considering day and age, profiles sometimes may have difficulties setting certain positions or must trading at a price area you to definitely deviates from the real-time field mediocre. The brand new Komodo System’s flagship decentralized application is a good multiple-strings non-custodial bag, DEX, and you may connection all the rolled to your one application. It’s the fresh widest cross-chain trading service of every decentralized replace in the industry, in addition to one another P2P DEXs and you can AMM DEXs. AMM DEXs, such Uniswap and you can SushiSwap, incorporate liquidity pools and you can analytical formulas to find the price of assets.

Along with, know how to start exchange perpetuals on the DeFi which have one step-by-action book. Speak about 20+ must-learn stablecoins, how they work, and just why they’re important for balance, change, and DeFi in the fast-paced field of cryptocurrency. Now you comprehend the difference in CEXs and DEXs, it’s time and energy to initiate trade crypto yourself. The cheaper choices utilizes the brand new system make use of and just how have a tendency to your change. Even when DEXs is actually growing inside prominence, it’s possible to’t refuse one to CEXs nevertheless take over them with regards to the trade frequency. As the an excellent DEX performs deals for the-chain, miners need confirm this type of purchases prior to adding them to the brand new cut off.

Centralized exchanges try companies that have to pursue regulators laws and regulations. It indicates they often want KYC, that has ID confirmation or even proof earnings. Of numerous DEX programs look technical, with charts and you will choices which might be hard to know.